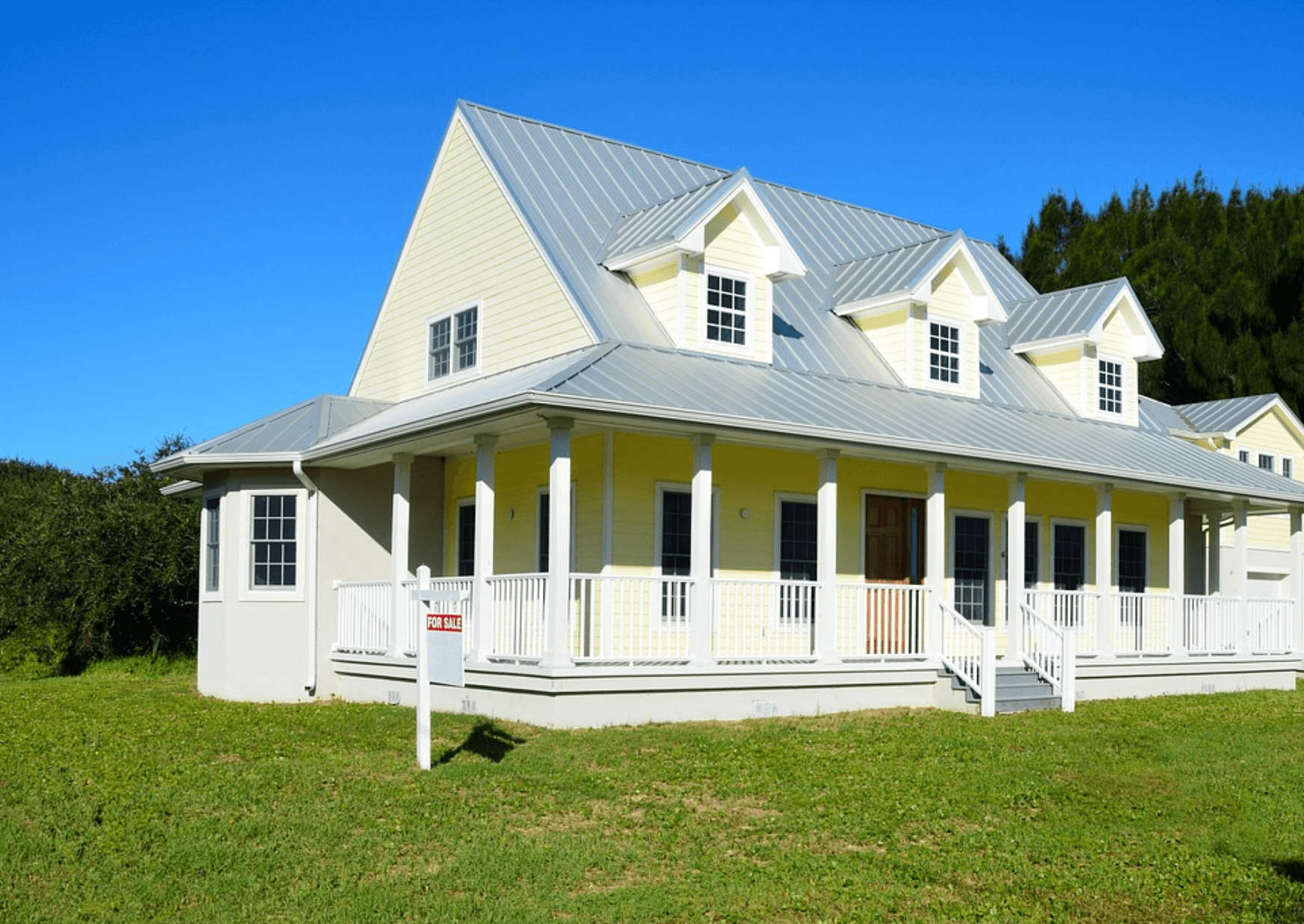

How Mortgage Lenders Market Products in the Summer

Summer is the peak season for the housing market because as people look to relocate before the school year begins or take advantage of warm-weather open houses, mortgage activity naturally tends to rise. Therefore, it should come as no surprise that summer presents a prime opportunity for mortgage lenders to connect with both homebuyers and current homeowners like you. more “A Guide to Summer Marketing from Mortgage Lenders”