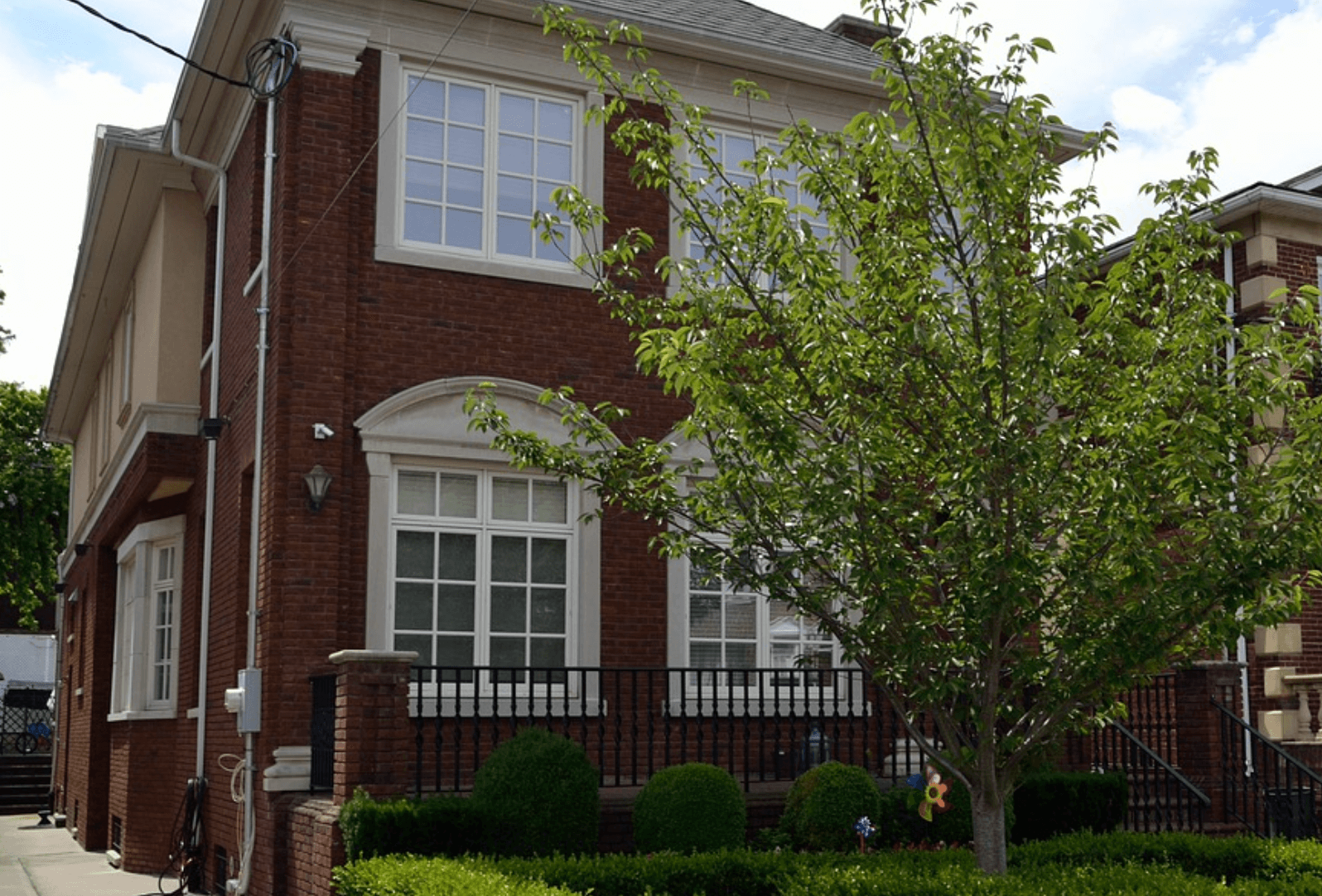

Ready to Buy Your First Home in 2023? Read These Mortgage Tips Now

For so many first-time homebuyers, saving up enough money to make a down payment on a home can take years. But as much of a challenge as it is, it is certainly worth it because putting at least 20 percent down on a home can help a first-time buyer secure a lower interest rate and avoid having private mortgage insurance (PMI) included in their monthly mortgage payment. That said, not every first-time buyer can save money when they have so many other financial obligations to satisfy. Luckily, help is available.

If you’re in the market for your first home but you’re having difficulty saving money for a down payment, then this doesn’t mean that you are going to be out of luck. Financing help is available from a variety of resources that can help you achieve your dream of owning a home in 2023. This guide will help get you started. more “Financing Help for First Time Homebuyers in 2023” …