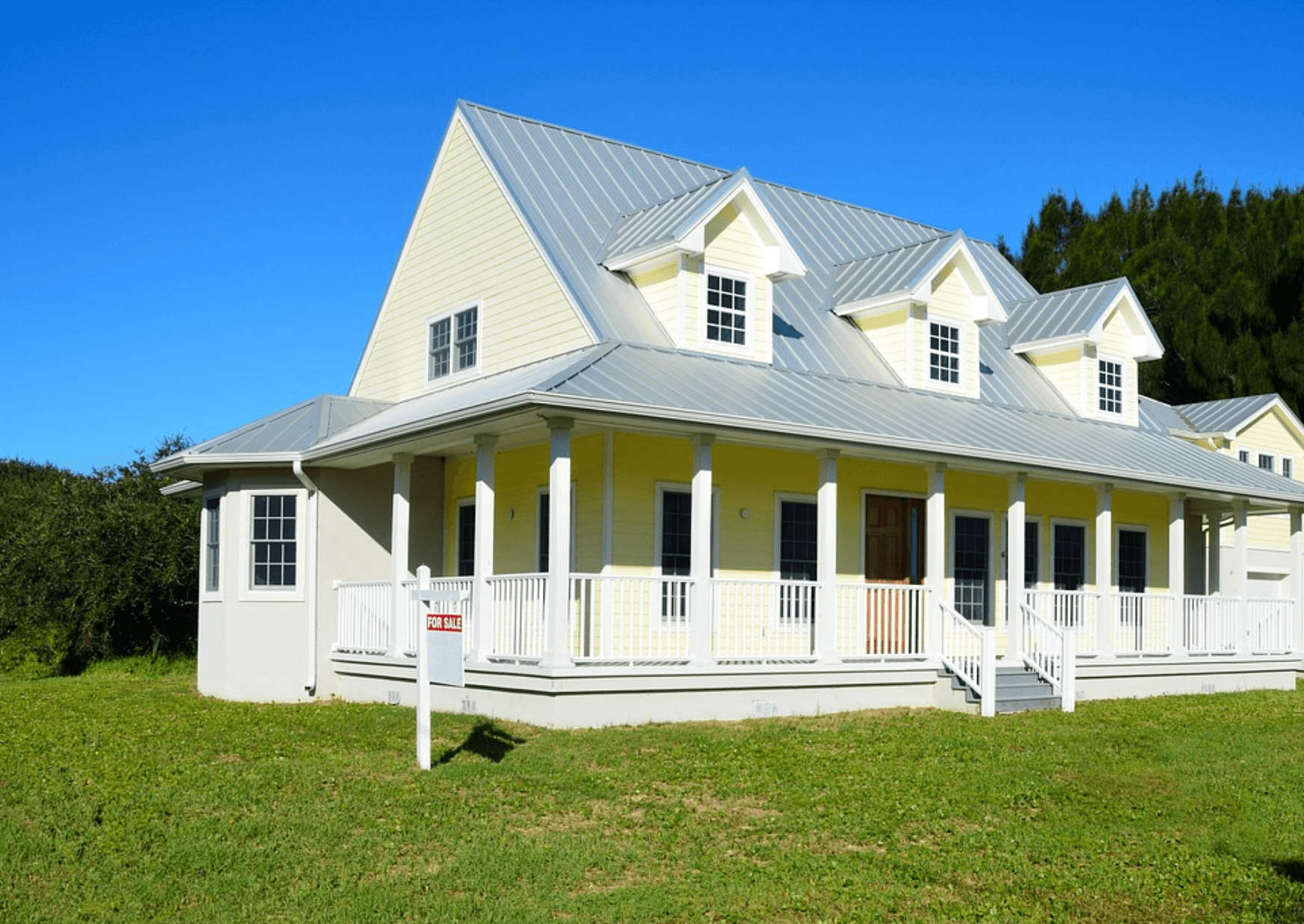

Weighing the Pros and Cons of a Home Refinance Now

Whether you’re talking real estate or finance, the decision to refinance your mortgage is one that should never be taken lightly. With interest rates and economic conditions constantly in flux, what might have been a wise choice a few years ago may not hold the same benefits today. more “Should You Refinance Your Mortgage in 2024?”